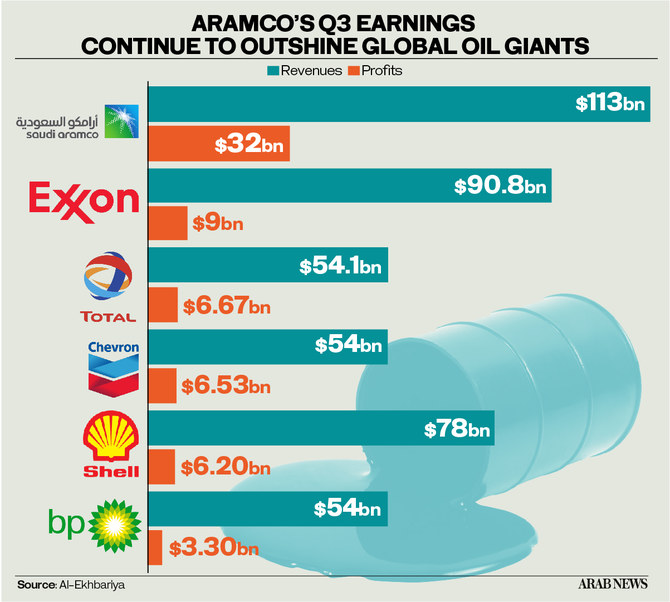

RIYADH: Saudi Aramco has reported a 8.31 percent increase in net profit in the third quarter of 2023, reaching SR122.19 billion ($32.6 billion) compared to the previous three months.

This increase was primarily driven by higher crude oil prices and improved refining margins.

Amin H. Nasser, president and CEO, of Aramco, said: “Our robust financial results reinforce Aramco’s ability to generate consistent value for our shareholders, and we continue to identify new opportunities to evolve our business and meet the needs of customers.”

In a statement, Aramco disclosed that its operational profit for the third quarter of this year had risen by 10.3 percent compared to the previous three-month period to reach $62.50 billion.

On an annual basis, net profit was 23 percent down compared to the third quarter of 2022 as a result of lower crude oil prices and reduced sales volumes, although this did slightly exceed analysts’ expectations.

Additionally, Aramco’s net profit of $94.54 billion for the first nine months 2023 represented a 27.46 percent decrease compared to the same period of the previous year.

Aramco noted that its operational and cash flow performance was primarily influenced by market prices and the sales volumes of hydrocarbons, refined products, and chemicals. Ongoing economic uncertainty led to reduced prices for hydrocarbons and narrower margins in refining and chemicals when compared to the same period in 2022.

Nasser stated that in the third quarter, the company had made its inaugural international investment in liquefied natural gas to capitalize on the increasing demand for LNG. Additionally, he mentioned the company’s plan to enter the South American retail market.

He added: “These planned investments demonstrate the scale of our ambition, the broad scope of our activities, and the disciplined execution of our strategy. I am excited by the progress we are making, which I believe will complement both our Upstream capacity expansion and our growing Downstream presence.”

Nasser further highlighted that Aramco will continue investing across the hydrocarbon chain, along with advancing the development of emerging energy solutions.

“It is an approach rooted in our belief that a balanced and realistic energy transition plan should consider the needs of all geographies, in order to avoid disparities between global energy consumers,” he said.

Driven by the stable results, Saudi Aramco declared a dividend payout of $29.38 billion for the third quarter of this year. This payout comprises a base dividend of $19.5 billion and a performance-linked dividend of $9.87 billion.