DUBAI: Green finance — an effort to factor sustainability into a traditional banking industry — made a big foray into the private sector for the first time in the Gulf. The retail giant Landmark Group became the first private company in the UAE to sign a sustainability-linked loan with Standard Chartered.

The loan was seen as a pledge to move toward sustainable green finance for the majority of the company’s operations.

“We have a team based on the ground in the region who are at the forefront of green finance, having structured the very first loan of this kind in the Middle East and North Africa region as long ago as 2018 for DP World,” explained Rola Abu Manneh, CEO at Standard Chartered Bank, in an interview with Arab News.

“These sustainable finance solutions allow companies to highlight their environmental, social and governance, or ESG, credentials to their stakeholders, potentially tap into new pools of liquidity, and help secure long term market access as ESG and climate become increasingly integrated into the financial markets,” she added. The agreement is significant as it demonstrates the keenness of the private sector toward greener practices in the traditional finance industry.

As it currently stands, the green finance sector in the Gulf Cooperation Council has made significant progress within the public sector.

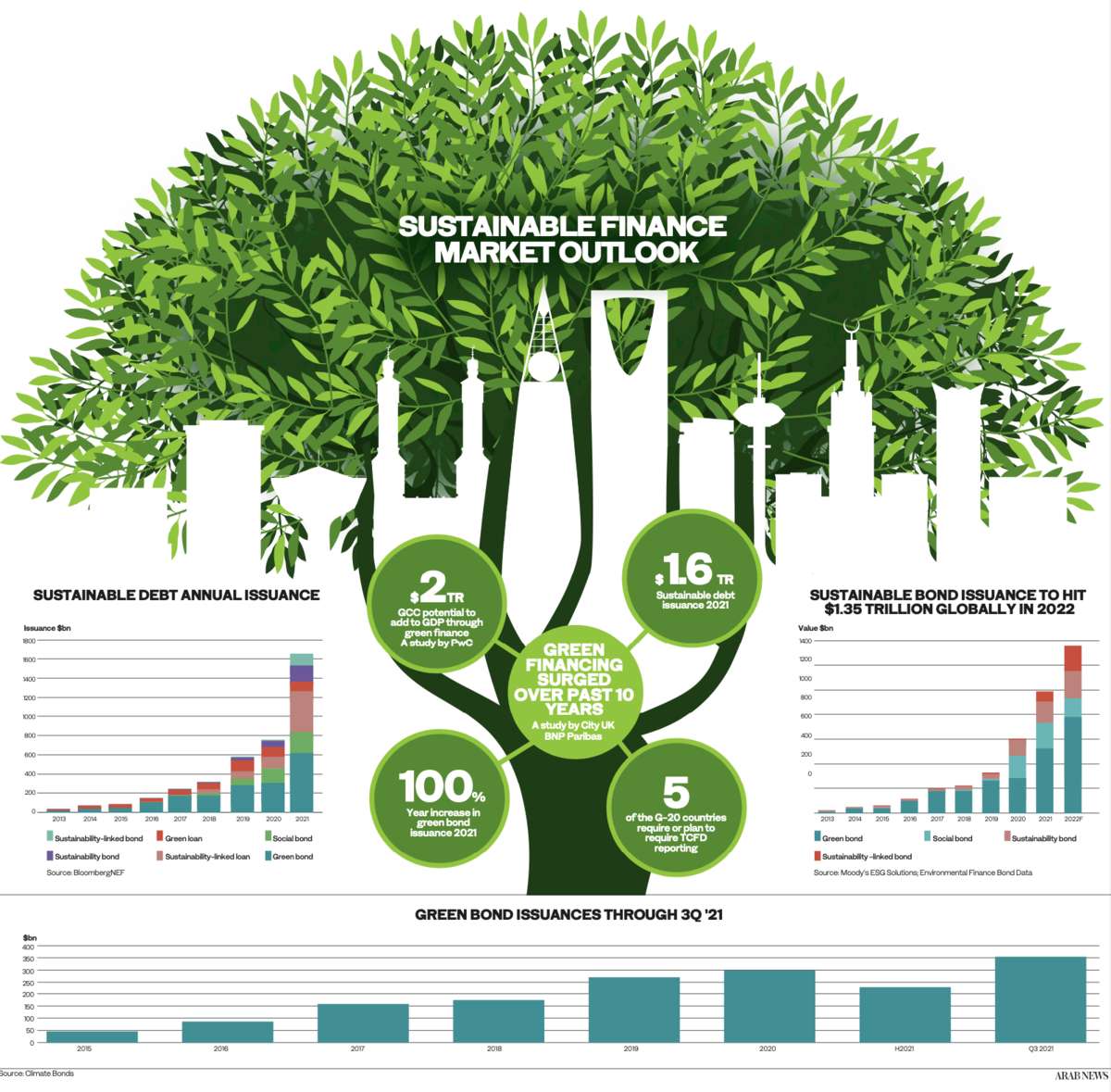

According to recent data from Bloomberg, green and sustainability-linked debt issuance in the MENA region reached $6.4 billion in the first half of 2021, a 37-percent increase compared to $4.7 billion in 2020. “Therefore, one can only imagine how much impact the involvement of the private sector will have,” Jelena Janjusevic, associate professor, Academic Head of Accountancy, Economics and Finance and Executive Education, at Heriot-Watt University Dubai. “There is no doubt that this is a significant step for the MENA region.”

Opinion

This section contains relevant reference points, placed in (Opinion field)

Renewable projects

Janjusevic stressed that the Kingdom has made significant strides in procuring renewable projects as part of its Vision 2030 in which renewable sources are set to account for 50 percent of Saudi Arabia’s energy production by 2050. There has been a strong incentive in the Kingdom in recent years to attract private sector involvement.

Last year, Saudi Crown Prince Mohammed bin Salman announced a new program to strengthen the partnership with the private sector.

This is part of the county’s economic diversification strategy to invest SR5 trillion ($1.3 trillion) until 2030 in this program.

“Combined with the Kingdom’s renewable energy agenda, the prospective investment of the private sector in green finance will undoubtedly create a boom in green finance,” she said.

Positive outlook

A recent study by Bloomberg shows that the region’s syndicated market for green and sustainability-linked bonds and loans will continue to mature and deepen as the total issuance reached $18.64 billion in 2021, compared with $4.5 billion in 2020.

“Although the market accounts for a small percentage of international volumes, there is no doubt that the MENA region significantly outpaced growth in comparison to 2021,” she said.

Sustainable finance

Sustainable finance

“The sustainable finance market has erupted globally over the last few years and we have seen a number of landmark deals in the region which have actually been world firsts,” said Abu Manneh. “With the recent commitments from several regional governments (Saudi Arabia, the UAE and Bahrain) to become net zero, we expect to see a greater focus from companies in the region on their ESG agenda and how they can play their part in meeting net zero. Sustainable finance is a key tool for realizing their goals and we expect to see continued growth in this space as a result.”

The delay in developing the required regulatory and institutional framework for green finance projects are among the main reasons for its slow progress in the region.

However, this is now changing and one of the reasons behind the boom in the total issuance of sustainability-linked loans in 2021 is the increased involvement of banks, including Riyad Bank, National Bank of Kuwait and Qatar National Bank.

“Implementing sustainable finance frameworks and setting up the infrastructure required to ESG debt financing is the first step that should be undertaken for green finance to flourish,”

said Janjusevic. “Despite the nascence of green finance in

the region, continuous initiatives and private sector involvement is sure to yield outstanding results in the near future.”