RIYADH: Entrepreneurs in Egypt’s priority sectors will soon gain access to affordable financing, as the 2025/2026 state budget earmarks 5 billion Egyptian pounds ($100.8 million) to support micro, small, and medium-sized enterprises.

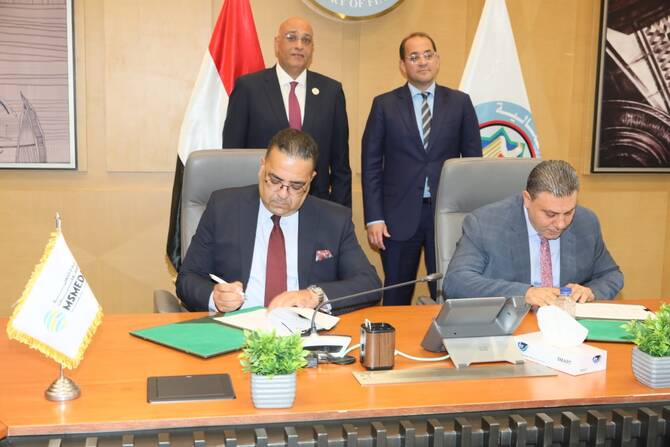

This partnership between the North African country’s Ministry of Finance and the Micro, Small, and Medium Enterprises Development Agency, which accounts for the largest economic support in the new budget, represents a significant step in bolstering the private sector and productive industries, according to a statement.

This move supports financial policies that boost private sector activity and promote entrepreneurship, aiming for financial sustainability while enhancing MSMEDA’s contribution to business growth nationwide.

It also aligns with recent data showing that startups across the Middle East and North Africa raised $289 million through 44 deals in May, a 25 percent increase from April and a 2 percent rise year-on-year. Egypt led regional fundraising with $125 million, driven by Nawy’s $75 million round alongside seven other deals totaling $50 million.

The newly released ministry statement said the money “will contribute to providing easy financing for young entrepreneurs, targeting priority sectors more closely.”

It added: “This comes as part of a new phase of strong and effective cooperation with the agency, aiming to achieve financial sustainability for the agency to drive economic growth.”

The statement further revealed that Egypt’s Finance Minister Ahmed Kouchouk noted that an initial agreement with MSMEDA has been reached to fund initiatives that support tax relief beneficiaries, promote entrepreneurship, and boost local manufacturing, as well as empower low-income households and advance export-focused projects.

Kouchouk added that this fiscal year, the initial group of businesses enrolling in the simplified and unified tax system would receive access to preferential, low-cost financing.

Basel Rahmi, CEO of MSMEDA, commended the Ministry of Finance’s efforts to back emerging businesses and boost private-sector expansion.

Rahmi praised the minister’s proactive vision, noting it would open doors for empowering young entrepreneurs economically.

In June, a statement issued by the Ministerial Group for Entrepreneurship indicated that Egypt’s startup ecosystem saw notable progress in securing venture capital and debt financing in the first five months of the year, with tracked deals totaling $228 million since January.

The statement further revealed at the time that 16 deals were completed between January and May, with 11 of them publicly disclosing investments amounting to $156 million. These investments represented a 130 percent rise compared to the volume during the same period last year.