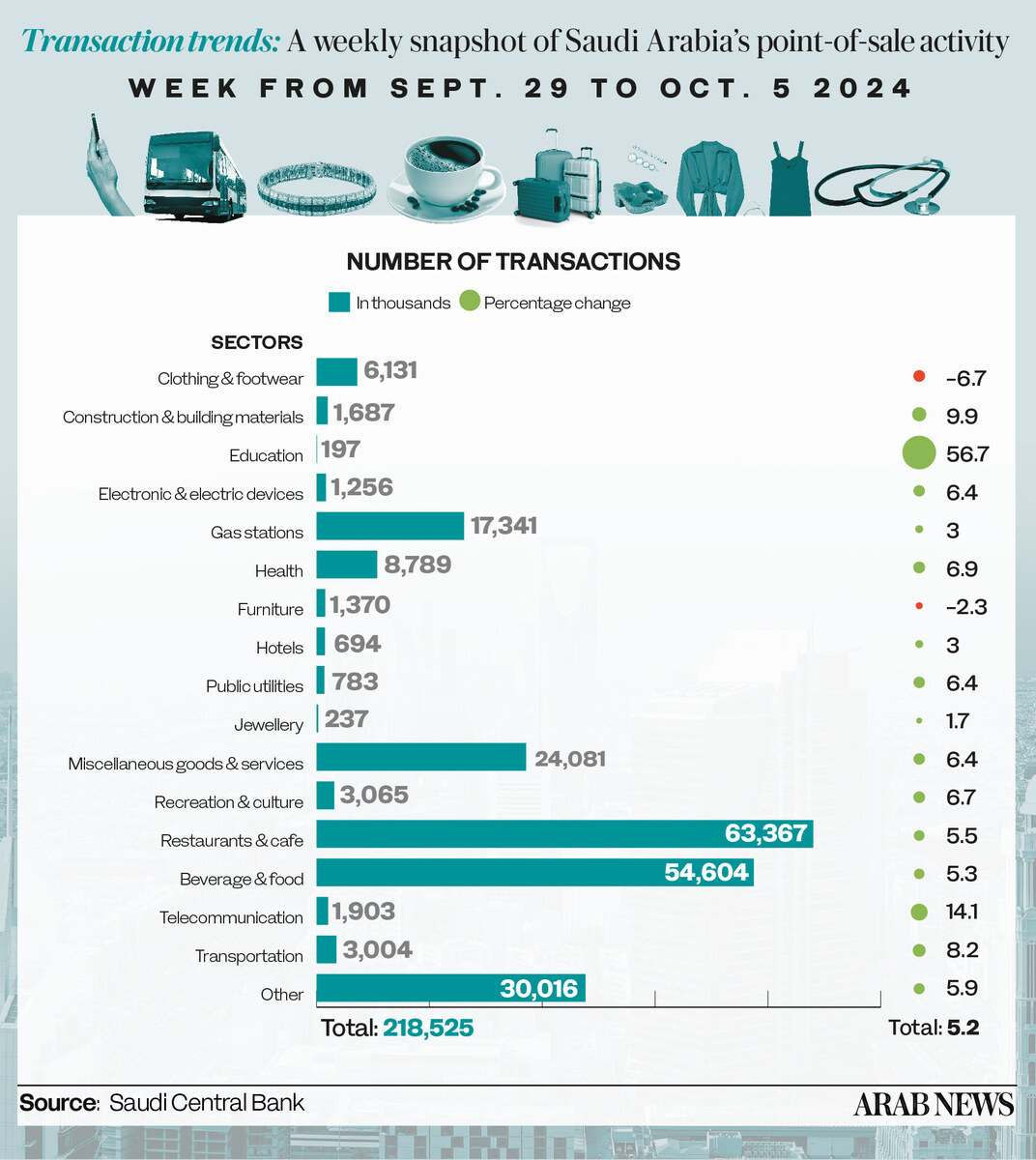

RIYADH: Saudi Arabia’s point-of-sale transactions climbed 2.6 percent to SR13.7 billion ($3.6 billion) in the week ending Oct. 5, driven by a sharp increase in spending within the education sector, official data showed.

The latest figures from the Saudi Central Bank, also known as SAMA, showed that the education sector led the growth with a 96.8 percent surge in transactions, totaling SR196.8 million, following weeks of declines since the academic year started in August.

Telecommunication spending followed, rising 17.4 percent to SR136.5 million. The public utilities sector recorded the third-largest increase, with a 13.9 percent jump to SR61.5 million.

Expenditure on furniture saw the largest decline, dropping 11.7 percent to SR349.3 million during this period.

Spending on electronic devices fell 8.4 percent to SR238 million, while clothing and footwear saw a 7.4 percent decrease to SR757.3 million. Recreation and restaurant expenditures also declined by 2.4 percent and 1.9 percent, respectively.

These five sectors were the only ones to register declines, while the majority of industries experienced growth.

In terms of transaction value, the food and beverages sector retained the largest share of POS spending, totaling SR2.22 billion, followed by restaurants and cafes at SR1.95 billion, and miscellaneous goods and services at SR1.77 billion.

Spending in these top three categories accounted for approximately 43.3 percent, or SR5.9 billion, of the week’s total POS value.

Geographically, Riyadh led POS transactions, representing 34.3 percent of the total, with spending in the capital reaching SR4.71 billion, the second-highest increase at 4.7 percent.

Jeddah followed with a 2.2 percent rise to SR1.86 billion, accounting for 13.6 percent of the total. Dammam ranked third with SR697 million, recording the highest increase at 5.8 percent.

Tabuk saw the third-largest spending increase, up 4.2 percent to SR276.2 million. Hail and Abha also experienced growth, with expenditures rising 1.7 percent and 0.5 percent to SR224.6 million and SR168.6 million, respectively.

In terms of the number of transactions, Dammam saw the highest increase at 6.8 percent, reaching 9,112 transactions. Hail and Buraidah recorded the smallest increases at 2.9 percent each, with 4,046 and 4,964 transactions, respectively.