TOKYO: Nintendo shares jumped more than four percent Monday after a top official of Saudi Arabia’s sovereign wealth fund was quoted as saying it was mulling hiking its stake in the Japanese gaming giant.

Riyadh has built up a stake of 8.6 percent in Nintendo as part of a $38-billion push into gaming under Crown Prince Mohammed bin Salman’s Vision 2030 program to diversify away from oil.

It also has stakes in “Resident Evil” maker Capcom, Activision Blizzard, Electronic Arts, and Scopely, the US mobile games company behind “Monopoly Go!.”

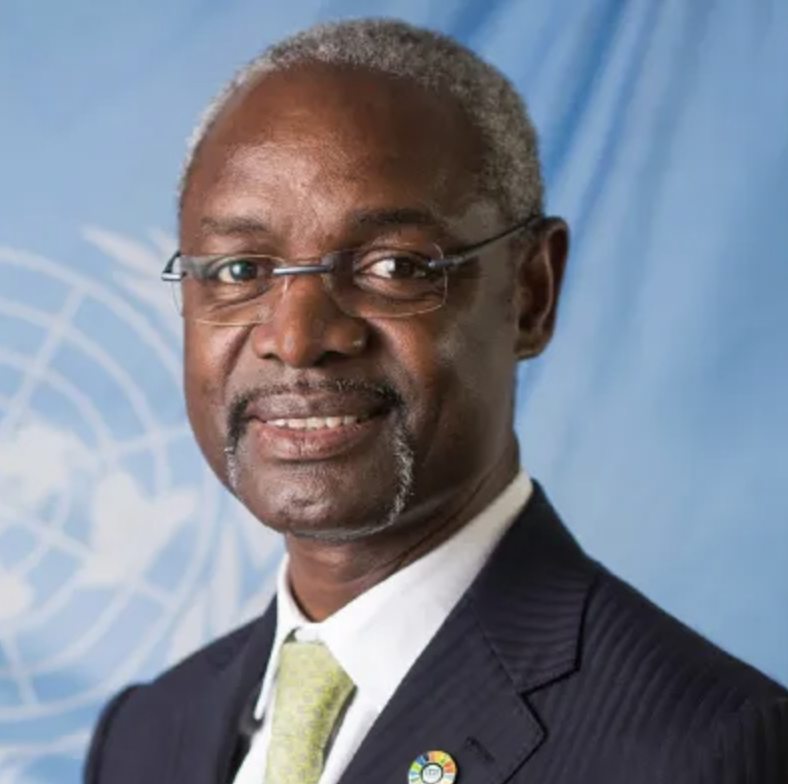

“There are always opportunities,” Prince Faisal bin Bandar bin Sultan, vice-chair of Saudi Arabia’s Savvy Games — a subsidiary of the Public Investment Fund — told Kyodo News in an interview published Saturday.

He added, however, that the fund had no intention of raising stakes without the consent of the firms concerned.

“It’s important to keep the communication going so you get there in the right way,” he said. “We don’t want to rush into anything.”

Nintendo’s shares jumped 4.44 percent Monday to end at 8,087 yen ($54.48).

Saudi Arabia aims to create 250 gaming companies and studios on its soil, 39,000 game-related jobs, be in the top three of professional gamers per capita and to produce a blockbuster “AAA” game by 2030.

Savvy has already bought esports tournament organizer ESL Gaming and platform FaceIt. Riyadh last year hosted the eSports World Cup that saw 2,500 gamers battle for $60 million in prize money.

“There’s a lot we want to do to get it done and to reach our targets at 2030,” Prince Faisal told AFP in an interview in May.

“But we also want to make sure that we are taking the time to study things, to look at things. And make sure we’re making the right steps and not just throwing cash out there to see what hits,” he had said.

Nintendo shares rise on Saudi Public Investment Fund report

https://arab.news/m9ca5

Nintendo shares rise on Saudi Public Investment Fund report

- Nintendo’s shares jumped 4.44% to end at 8,087 yen

- Kingdom has built up a stake of 8.6% in Nintendo as part of a $38-billion push