ISLAMABAD: Pakistan’s financial experts and opposition figures said on Friday the new federal budget would increase inflationary pressure in the economy and expand the fiscal deficit while calling the government’s tax and non-tax revenue targets “unrealistic.”

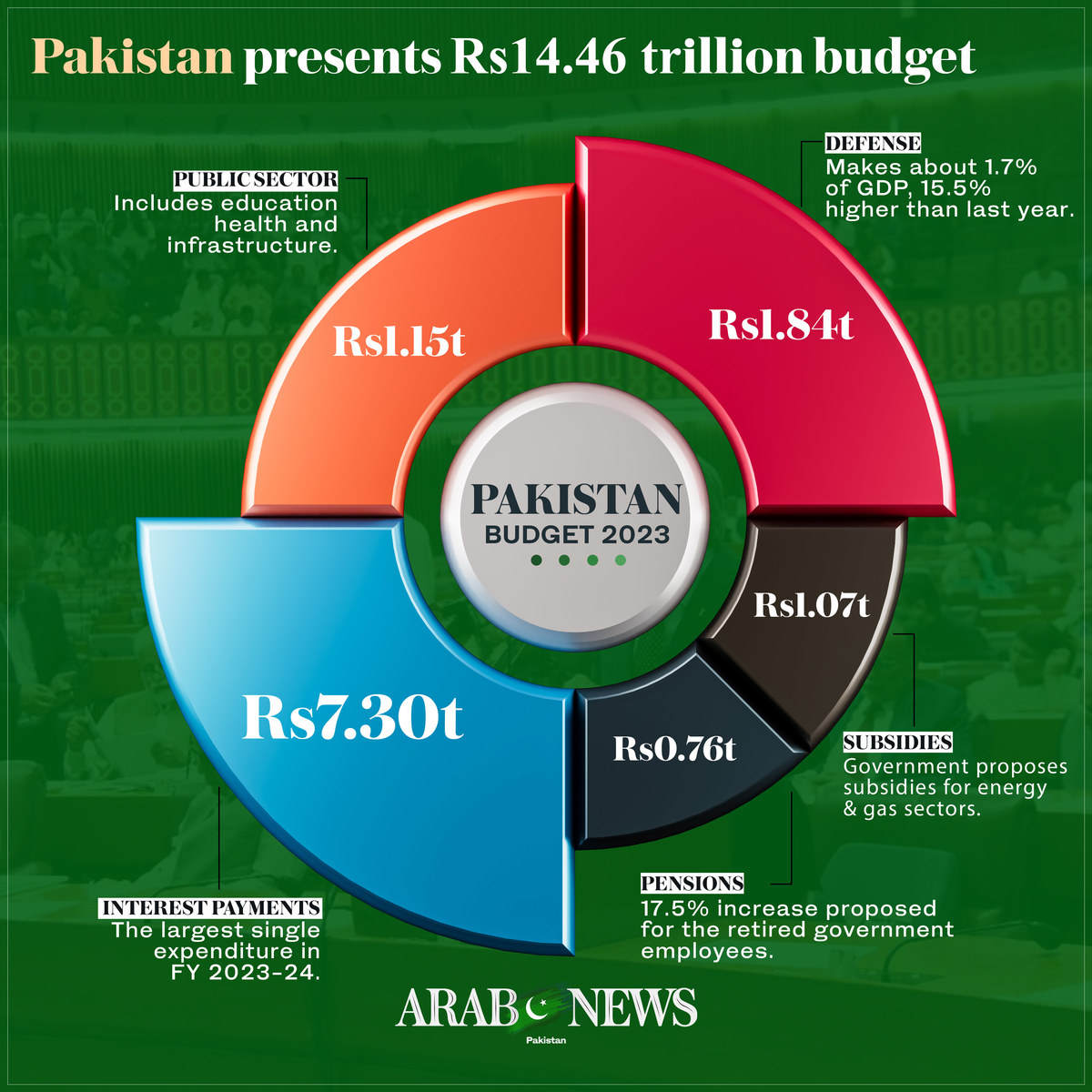

The country’s finance minister, Ishaq Dar, presented a Rs14.46 trillion ($50.4 billion) budget at the National Assembly for the next fiscal year, setting a tax collection target of Rs9.2 trillion ($32 billion), which is 23 percent higher than last year, and envisioning a 3.5 percent GDP growth.

The government unveiled its fiscal plan amid record inflation, a depreciating currency, and declining foreign exchange reserves. While it stated its intention to provide relief to financially vulnerable segments, the budget numbers were also aimed at securing the release of a $1.1 billion tranche under a stalled $6.5 billion International Monetary Fund (IMF) bailout program for the country.

“It’s an inflationary budget and will lead to more price hikes,” senior Pakistani economist Ammar Habib Khan told Arab News.

The Infographic shows the five major expenditures proposed in Pakistan's federal budget for the fiscal year 2023-24. (AN Photo)

He criticized the government for its “inability to expand the tax net,” adding that its decision to raise salaries and other government expenditures would result in further fiscal deficit amid increased borrowing pressure.

“As the government takes on more debt, it will have to pay historically high interest rates, which will deteriorate its fiscal position,” he continued.

Karachi-based economist Asif Arsalan Soomro maintained the budget was an attempt to explore new tax avenues, though he believed the effort was likely to fail.

“Although benefits are given to the IT and agriculture sectors, the documented sectors are now slapped with higher super tax,” he told Arab News.

Soomro said the ruling coalition had decided to give a 30-35 percent salary increase to government employees, but it had not offered any material relief.

He argued that a general amnesty scheme should have been implemented to allow remittance of $100,000 per year without questions asked, in order to encourage dollar inflows.

“Companies that have enjoyed exchange gains would claw back to the government the windfall gains,” he said.

Former prime minister Imran Khan’s opposition Pakistan Tehreek-e-Insaf (PTI) party also described the government’s tax and non-tax revenues as “unachievable,” saying the IMF would not accept the budget.

“This budget will bring an inflationary storm since it lacks discipline and cogent policy measures to achieve tax revenue,” Muzammil Aslam, PTI’s focal person on economy and finance, told Arab News.

He said the government had increased the tax and non-tax revenue targets in the budget without clearly mentioning a plan to achieve them. This was despite the fact, he continued, that the finance minister had claimed it was a tax-free budget.

“The tax targets are unrealistic and unachievable with a 3.5 percent growth target in FY24,” he said. “The IMF is not going to accept this budget, and unfortunately, our economy is poised to further deteriorate in the coming months.”

Former chairman of the Karachi Chamber of Commerce and Industry (KCCI), Zubair Motiwala, said the government had set a tax revenue target of Rs9.2 trillion in the budget, but its expenses were much higher than that.

He also maintained there was not much in the budget document for Pakistani exporters.

“This budget will not bring any relief to the country’s export sector,” he said, adding that an increase of 30-35 percent in government employee salaries would burden the economy.

Topline Securities, a brokerage house in Karachi, expressed uncertainty about how the government would repay external loans estimated at around $22 billion in FY24, adding that it would impact the local currency, interest rates, and the stock market.

“It is yet not clear as to how the government will repay external loan estimated at around $22bn in FY24,” the company said in a statement.