RIYADH: Saudi Arabia’s stock market has been witnessing a wave of new listings since the beginning of the year reaching 246 by the end of the second quarter of 2022.

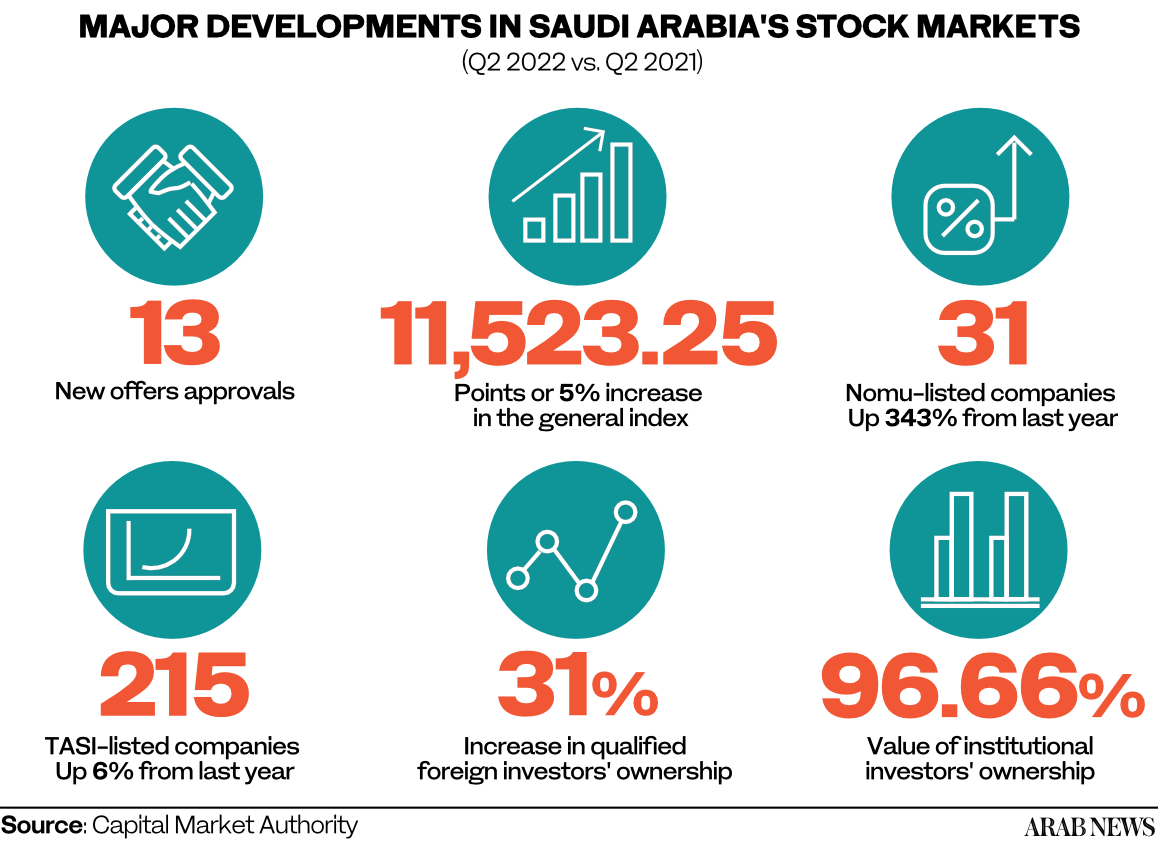

Listed firms on the main index, Tadawul All Share Index, rose 6 percent to 215, while the remaining 31 were on the parallel Nomu market, revealed a report by the Capital Market Authority.

Nomu, which offers lighter listing requirements, saw a 343 percent surge in the number of companies joining the index in the three-month period compared to the last year.

The report highlighted that approvals for new offers on Tadawul reached 13 during the quarter.

In terms of index performance, TASI recorded an increase of 5 percent on the year to end the quarter at 11,523.25 points.

The total number of individuals with ownership in the Saudi stock market was 5.67 million at the end of the three-month period, while the number of portfolios held rose to 10.8 million from 10.1 million in the prior quarter.

Qualified foreign investor ownership alone surged to SR284 billion ($76 billion) in the same period, up 31 percent from SR216 billion a year earlier.

When it comes to total foreign investment by swap holders, foreign residents, QFI, foreign diversified portfolio managers, and foreign strategic investors, the ownership rose to SR354 billion at the end of the second quarter from SR276 billion a year ago.

Overall institutional investors held 96.6 percent of the total ownership in the market of SR11.4 trillion, while the remaining 3.34 percent belonged to non-institutional investors at the end of the three-month period.

For investment funds, Saudi public funds’ assets dropped 29 percent in value during the second quarter this year compared to 2021, as they invested less in money markets.

Assets’ value decreased to SR193 billion from SR242 billion in the corresponding period in 2021.

The decrease was mainly driven by a decline in the value invested by funds in money market instruments to SR101 billion, holding the highest share of funds’ assets.

The value of assets in this investment category dropped 35 percent from SR155 billion in the prior-year period, despite the addition of a new money market fund this year.

Equities of public funds slightly fell in value to SR24 billion from SR25 billion year-on-year, while debt instruments went up to SR26.9 billion from SR25.6 billion.

The total value captures investment across different asset classes including equities, debt, money market instruments, real estate, exchange-traded funds, funds of funds, real estate investment trusts, endowments, multi-asset, and others.