https://arab.news/ynsgw

- Funds dropped by SR23.2 billion in Q2 of 2022, Saudi Central Bank data shows

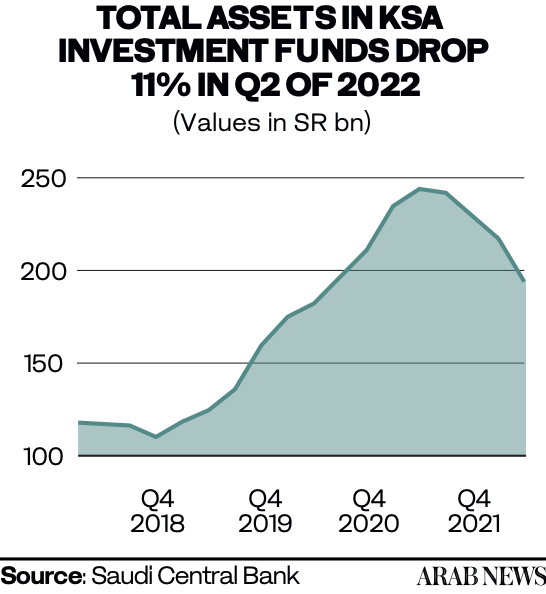

The total assets of Saudi Arabia’s investment funds dropped by SR23.2 billion ($6.2 billion) in the second quarter of 2022, according to data from the Saudi Central Bank, also known as SAMA.

This drop recorded the steepest fall the Kingdom has seen since the second quarter of 2006, when the decrease in total fund assets amounted to SR30 billion.

While the 2006 downturn was predominantly driven by the SR28.8 billion drop in the country’s domestic shares, this year’s tumble was due to a more general decrease in an array of asset types.

Foreign money market instruments witnessed the largest decrease of SR8.7 billion in the second quarter of this year.

Domestic shares and other domestic assets decreased by SR6.4 billion and SR4.5 billion respectively in the second quarter.

Furthermore, domestic money market instruments and domestic sukuk and bonds fell by SR4.1 billion and SR1.3 billion respectively, according to SAMA data.

Investment funds’ assets have been seeing a downward trend since the third quarter of 2021.

Total assets fell 1 percent by SR1.8 billion in the third quarter of 2021, reaching SR240 billion.

Total assets fell by 5 percent in the fourth quarter of 2021 to SR227 billion, and by another 5 percent in the first quarter of 2022 to SR216 billion quarter on quarter, showed the SAMA data.

The latest data showed a staggering 11 percent drop in the second quarter of this year, totaling SR193 billion. The Kingdom’s second quarter investment funds comprised SR143 billion worth of domestic assets and SR50 billion worth of foreign assets, according to the data.

Domestic assets fell twice in the past year; they dropped by SR7.7 billion in the fourth quarter of 2021, and then by SR15.4 billion a year later.

However, these assets witnessed a SR10.4 billion jump in the previous quarter of this year, as well as a moderate rise of SR138 million in the third quarter of 2021.

Foreign assets have been declining the past four quarters; they dropped by SR2.0 billion, SR5.0 billion, SR21.9 billion and SR7.7 billion in each quarter within that time frame, showed the data.

FASTFACTS

While the 2006 downturn was predominantly driven by the SR28.8 billion drop in the country’s domestic shares, this year’s tumble was due to a more general decrease in an array of asset types.

Foreign money market instruments witnessed the largest decrease of SR8.7 billion in the second quarter of this year. Domestic shares and other domestic assets decreased by SR6.4 billion and SR4.5 billion respectively in the second quarter.

At the end of the second quarter of this year, there were 254 operating funds and approximately 666,000 subscribers for the country’s investment fund.

The number of open-ended investment fund assets in the second quarter amounted to SR160 billion, which is SR25 billion less than the previous quarter.

Close-ended assets, on the other hand, saw an increase of SR1.9 billion in that quarter, reaching a total of SR32.7 billion. Domestic money market instruments held the largest share of total invest-ment fund assets, accounting for 34 percent of the total.

Foreign money market instruments came in second with 22 percent of total assets, whereas other foreign assets came in third with 15 percent.