Saudi Arabia’s cement producers saw their output fall in May, with the exception of Yamama Cement, according to the latest figures.

In the first five months of 2022, the volume of cement output across all companies fell 12.0 percent from the same period of 2021.

April saw a 13.7 percent fall — the deepest since January 2019.

It was only Yamama that saw a rise, surging 53.5 percent year-on-year — a cumulative increase of about 1 million tons of cement.

From January to May, Yamama managed to boost shipments by 1.1 millions tons, or 58.2 percent year-on-year.

It is also the only company that managed to achieve year-on-year increases in each of the first five months of 2022.

Responding to the figures, Mashael Alhuthaily, equity analyst at AlJazeera Capital told Arab News: “This can be attributed to the transfer plan to a new plant in Al Kharj Governorate in Riyadh, where the company provided a significant discount on its sale prices in Q1-22 of SR 106.9/ton ($28.49/ton) — a 19.4 percent decrease year-on-year — and to offload its inventory from the old plant, which in turn also helped the company gain greater market share.”

Only two other companies achieved some improvement over the same period – Tabuk and As-Safwa.

Tabuk increased sales by 88,000 tons, while As-Safwa saw a 25,000 tons rise.

Market Share

In the period from January to the end of May, Yamama’s share of the Saudi cement market has improved noticeably compared to the results for 2021.

Its share in the Kingdom’s total cement output increased by 3.5 percentage points to 13.4 percent, while in domestic cement sales it grew by 3.9 percentage points to 14 percent.

This has led to a reshuffle in the group of the three largest companies, as Yamama overtook both Southern and Saudi in terms of both output and domestic sales.

Saudi managed to retain second place in terms of cement output, while its market share slipped 0.1 percentage points to 11.6 percent.

Southern shifted down from first to third place as it saw its share fall 1.3 percentage points to 11.1 percent.

In terms of domestic cement sales, Southern ceded first place to Yamama and took second place with its share having declined 1.4 percentage point to 11.4 percent. Saudi took third place with 10.6 percent share.

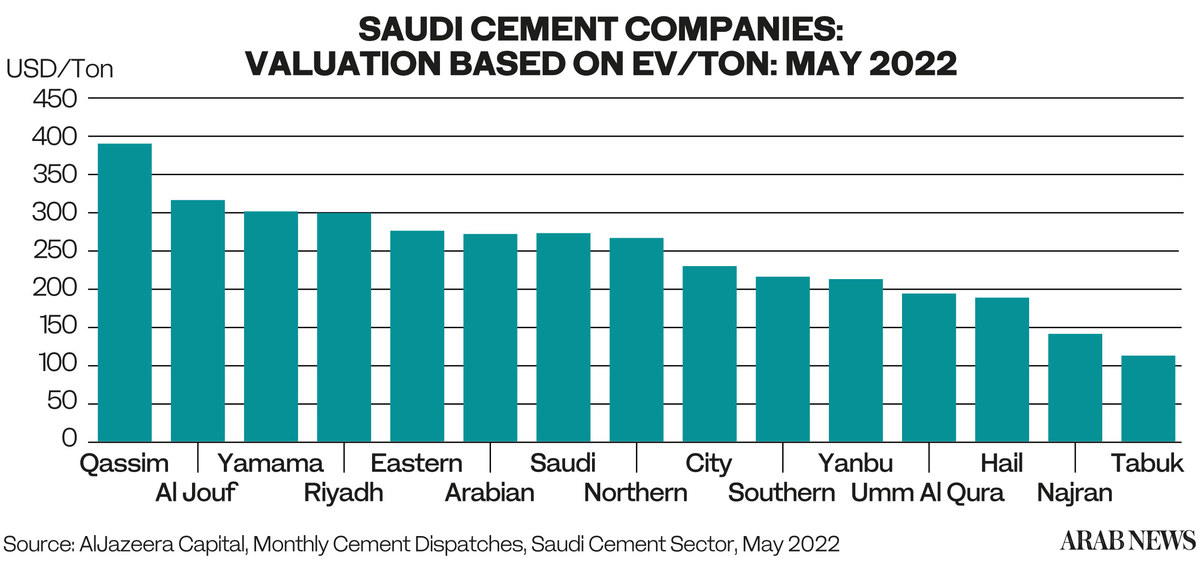

Based on market data for May, Yamama's shares were the most expensive based on enterprise value per ton valuation in the group of three largest companies, according to a research note issued by AlJazeera Capital earlier this year.

The multiple for Yamama was $307 per ton compared to $277 and $219 for Saudi and Southern, respectively.