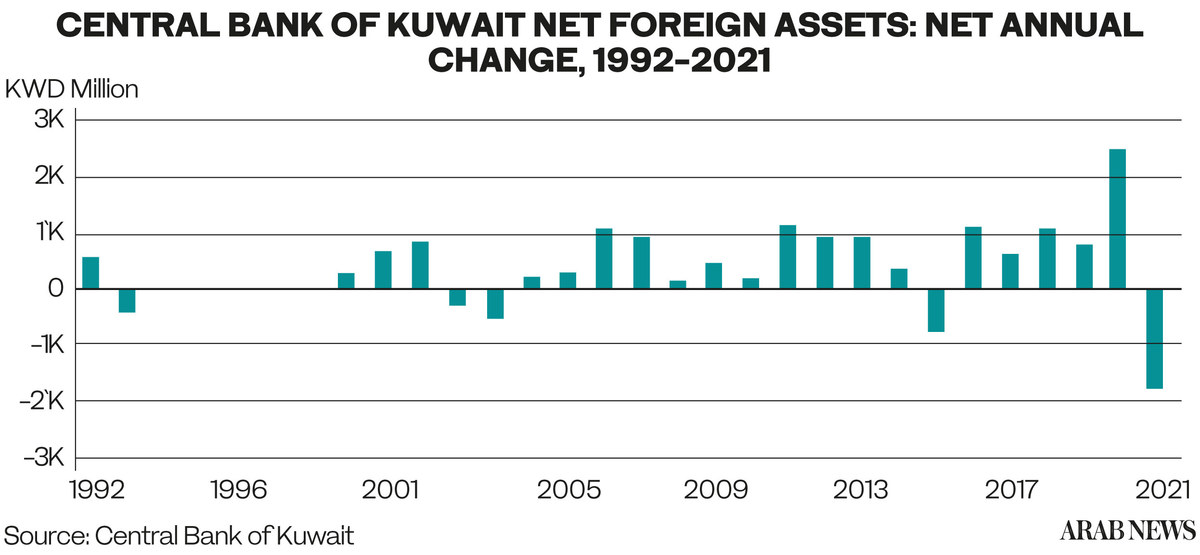

Net foreign assets of the Central Bank of Kuwait witnessed the biggest net annual fall on record, according to data issued by CBK in its Monthly Monetary Statistics Bulletin.

In December 2021, net foreign assets of the central bank — represented mainly by its holdings of foreign currency and deposits with foreign banks — fell by almost 390 million dinar ($1.29 billion) bringing the 2021 annual decrease to a total of 1.79 billion dinar.

This figure came as the biggest net annual decrease since 1992, the earliest period for which data is available.

The December decrease was this year's second biggest monthly drop after March, when the central bank's net foreign assets plunged by 821 million dinar.

In 2021 the CBK net foreign assets experienced six monthly decreases compared to three decreases in 2020.

From 1992 to 2021 CBK's new foriegn assets have seen only three annual decreases: a 438 million dinar drop in 1993, 421 million dinar in 2002 and most recently a 797 million dinar drop in 2015.

On the other hand, holdings of US Treasuries by Kuwaiti residents did not see significant changes from January to November 2021, with their value varying within a range of $45-47 billion, according to the most recent data from the US Department of the Treasury.

“Kuwait's fiscal balance deteriorated sharply to a deficit of 15.4 percent in the financial year 2020/2021 (1 April 2020 to 31 March 2021) due to lower oil revenue, fiscal support measures to ease the effects of the pandemic, and a slump in economic activity,” the International Monetary Fund said in a concluding statement of the 2021 Article IV mission for Kuwait issued in October 2021.

The statement projected the fiscal balance to improve to a surplus of 2 percent of gross domestic product in the financial year 2021/2022, but warned that in subsequent years continued expenditure pressures and declining oil prices may result in a widening deficit and a decline in government net assets.

The IMF went on to say that because a law allowing for additional borrowing up to a debt ceiling of 60 percent of GDP is still before parliament, “the fiscal financing has relied primarily on drawing down General Reserve Fund liquid assets.”