JEDDAH: Fintech Saudi was launched in 2018 by the Saudi Central Bank and the Capital Market Authority, to turn the Kingdom into an innovative fintech hub.

It has a digital strategy that supports regulators and the growing fintech startups that have emerged in the Kingdom over the past two years.

These moves are in line with Saudi Arabia’s Vision 2030 investment plan, to support entrepreneurship and promote financial services technology.

The Fintech body doesn't see itself as a technical incubator, the director of Saudi Fintech Nejoud Almulaik told Arab News.

Instead, it works with new firms in early development and incubates them, and also supports the wider growth of the industry itself.

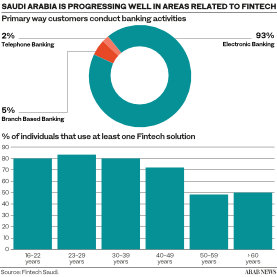

Ninety-three percent of those asked in a poll said they prefer banking online, according to a Saudi Fintech survey. Almulaik says the role of Saudi Fintech is to support that landscape.

Millennials – people between 25 and 40 – are more tech-savvy and make over 80 percent of their payments online, according to the report, helped by the government’s strong technology infrastructure.

Digital payments unit Stc pay became a unicorn – a privately-held startup valued at over $1bn – after Western Union snapped up a 15% stake in the business for $200m in November.

Almulaik said she expects to see more Saudi unicorns soon.

This year, Fintech Saudi plans a range of activities, including another Fintech Tour, following on from last November’s virtual event, which was the largest cluster of fintech events to take place in the Middle East, made up of 24 workshops, lectures and panel discussions.

This year, Fintech Saudi plans a range of activities, including another Fintech Tour, following on from last November’s virtual event, which was the largest cluster of fintech events to take place in the Middle East, made up of 24 workshops, lectures and panel discussions.

It will also work with Saudi Central Bank and Capital Markets Authority to update the country’s fintech strategy, which will include talks with the Ministry of education, the Ministry of Human Resources and other data and cyber security agencies.

New programs will be announced by end of this year or early next year, Almulaik said.

More than 80 percent of those asked in the Fintech Saudi survey said they would like to see more easy digital payment systems.

While between 60 percent and 20 percent named digital investment and saving as their top priority.

Almulaik said many of these types of apps and online systems are being tested and will be fully licensed soon.

Opinion

This section contains relevant reference points, placed in (Opinion field)

Digital currencies in Saudi have not been formally adopted, Almulaik said, but the Kingdom is seeing the use of e-wallets, where the money is actually reflected in the bank account as riyals and can be withdrawn in cash as well.

She added digital currencies are still under development by the central banks as central bank digital currency, and testing is taking place.

G20 central banks are actively at work on how digital currencies will fit into their economies, and Saudi is part of that process, Almulaik said.

The director said digital identity is recognized in the fintech strategy as a pillar of empowerment for financial technology. She added digital identity at this stage, such as the Tawakkalna app, developed during the pandemic, and the Absher government services app, shows this area is progressing well in Saudi Arabia.

Almulaik said Saudi is an open market that welcomes international firms establishing businesses in the Kingdom, and investment in the country’s fintech industry.

"Most of the fintech firms in Saudi Arabia are locally driven, with 80 percent of fintechs locally headquartered, while 20 percent are a combination of local and international investments", she added.