DUBAI: An Emirati-Swiss consortium is acquiring Bahrain’s BFC Group Holding, which owns the Gulf country’s largest money transfer and exchange company.

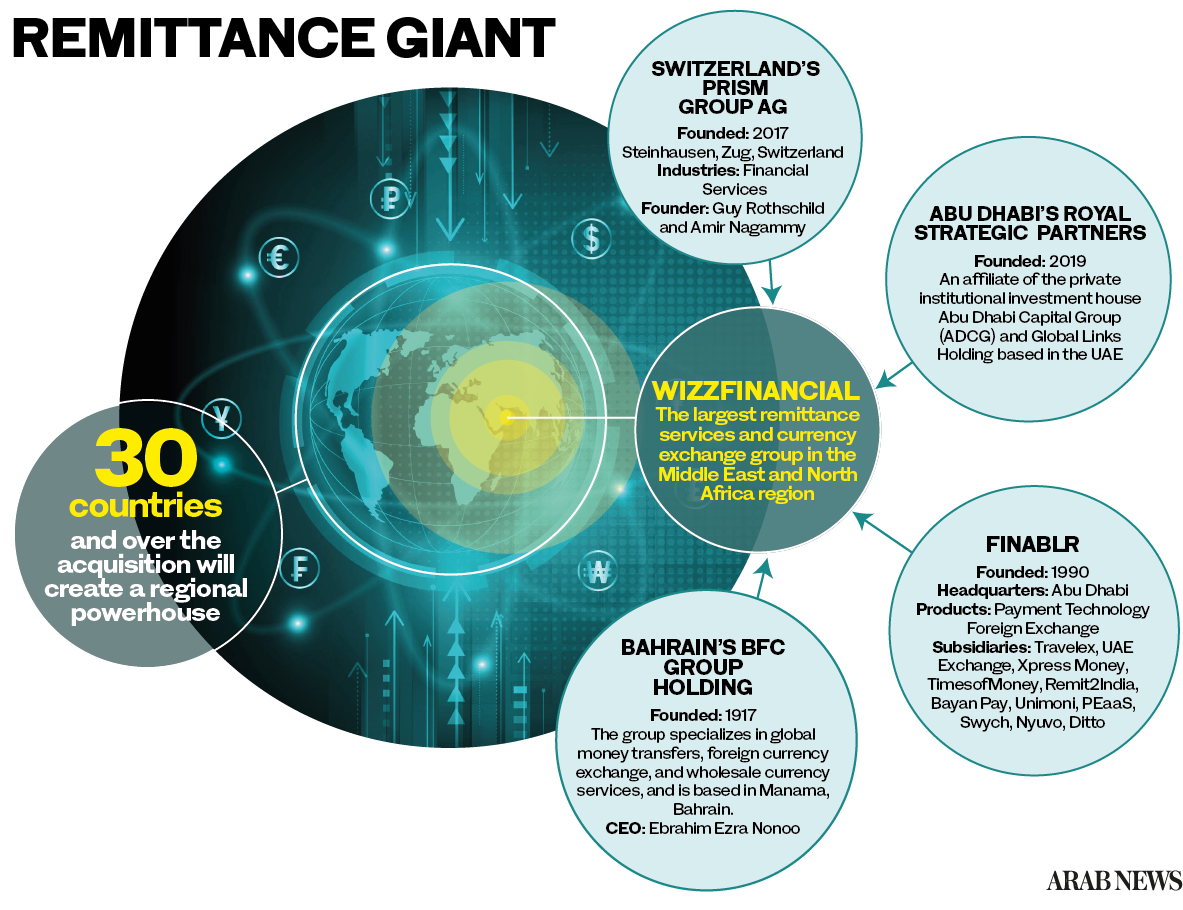

Switzerland’s Prism Group AG and Abu Dhabi’s Royal Strategic Partners have signed a deal to acquire BFC and its subsidiaries – BFC Bahrain, BEC Exchange (Kuwait), BFC Payments and BFC Forex and Financial Services (India).

BFC will be merged with WizzFinancial, formerly Finablr, the Abu Dhabi-based payments company acquired by the same consortium in December.

The deal creates one of the largest remittance and currency exchange groups in the Middle East and North Africa region, home to millions of migrants who regularly sending money home and vice versa.

“The acquisition creates a regional powerhouse with licenses to operate in over 30 countries,” the consortium said in a press statement.

The move comes amid a period of intense change for the financial sector as it adopts new technologies to create better user experiences.

“Everybody in the financial services arena is embarking on a digital transformation of some kind,” Anthony Wagerman, an adviser at Prism Group told Arab News. “It’s not really a matter of if, it’s a matter of when, and it’s a matter of how long that takes and ensuring your customers are with you.”

While a large part of the remittance market continues to rely on “tried and tested methodology,” the traditional money-sending sector has been disrupted by COVID-19, which “undoubtedly acted as a form of catalyst or accelerator for this digital journey,” he said.

The consortium’s investment in the businesses it is acquiring will help speed their digital transformation, but it is important to recognize that some customers will continue to use traditional methods, said Wagerman.

“We want to create a seamless service that’s completely omnichannel, from walk-up to online to mobile, because that is really the way the market is going now,” he said.

The deal comes amid evidence of impressive resilience in the sector during the COVID pandemic with remittance flows of $540 billion in 2020, just 1.6 percent below 2019 levels, according to World Bank data. That compares with a 4.8 percent decline during the global financial crisis.

Moreover, the remittance industry is set to almost double to $930.44 billion by 2026, according to Allied Market Research.

“The reports we’re seeing of the first coming up to the first half of 2021 is really quiet encouraging, and have shown a lot of businesses snapping back rather more quickly than people originally envisaged,” Wagerman said.

Asked how blockchain technology plays a role in the remittance industry’s digital journey, he said there is still a strong need for regulation in this area given the variation in countries’ different rules.

“There’s an overall attractiveness about having frictionless payments that avoided intermediaries, of course there is. The reality however is not so simple, not least because when money crosses borders, there’s all kind of issues particularly from a regulatory perspective,” Wagerman explained.