The week that was:

Global stock markets continued their decline this week following the lead of US markets. The range in Europe was tighter than elsewhere. US-China trade tensions, the impending American presidential election, and the coronavirus disease (COVID-19) pandemic weighed on markets.

The Nasdaq went into its first correction since March, prompting some hedge funds to buy on the dip. China’s tech heavy ChiNext Index fell through various levels of support.

Given the soaring prices, a tech correction may have been healthy. When the pandemic is over, some of the tech stocks will continue to capitalize on the behavioral shifts accelerated by the virus outbreak, such as remote education.

However, there will also be some reallocation into value stocks and cyclicals at that time. While stimulus packages are high and interest rates low, equities remain overall attractive compared to other asset classes.

US first-time jobless numbers for the week ending Sept. 5 came in higher than expected at 884,000, as compared to 881,000 for the preceding week.

The UK government continued to insist on its internal market bill which will override the Brexit withdrawal agreement on two points and constitute a breach of international law.

The EU has given the UK government until the end of the month to sort the issue out, but the UK seems unwilling to budge. This makes a disorderly Brexit more likely, despite all the assertions to the contrary.

On the back end of the controversy, the pound had its longest losing streak since May and the FTSE 100 dropped by 1.2 percent on the news.

Luxury goods company LVMH has abandoned plans to acquire jewelry and specialty retailer Tiffany and Co. for $16 billion which would have been the luxury sector’s largest takeover. The deal seems to have faltered on the possibility of US import tariffs on French goods and Tiffany’s management during the pandemic. LVMH chief, Bernard Arnault, is contemplating suing Tiffany for the latter.

Citigroup named Jane Fraser, who is president and CEO of its consumer bank, as the company’s CEO as of February, making her the first woman to head a major Wall Street bank.

Rio Tinto’s CEO Jean-Sebastien Jacques is stepping down amid controversy over the destruction of historical aboriginal sites in Australia, proving that environmental, social, and corporate governance (ESG) criteria are also taking hold among mining companies.

Focus:

The European Central Bank’s (ECB) governing council kept lending rates and the stimulus package on hold. The bank improved its 2020 forecast for the eurozone from minus 8.7 percent to minus 8 percent while slightly lowering its growth forecast for 2021 to plus 5 percent.

There was focus on the euro, which has appreciated more than 10 percent against the dollar since March, putting negative pressure on prices. Even with the improved forecasts, inflation is predicted to stand at 1.3 percent by 2022, which is well below the 2 percent target.

ECB chief economist, Philip Lane, said that the bank would augment the stimulus if necessary and its president, Christine Lagarde, reiterated that the governing council would adjust all of its instruments to bring inflation in line with its target.

Overall, the ECB is expected to lower interest rates or raise its bond purchasing program, if necessary. However, the necessity for fiscal stimulus remains another part of the equation.

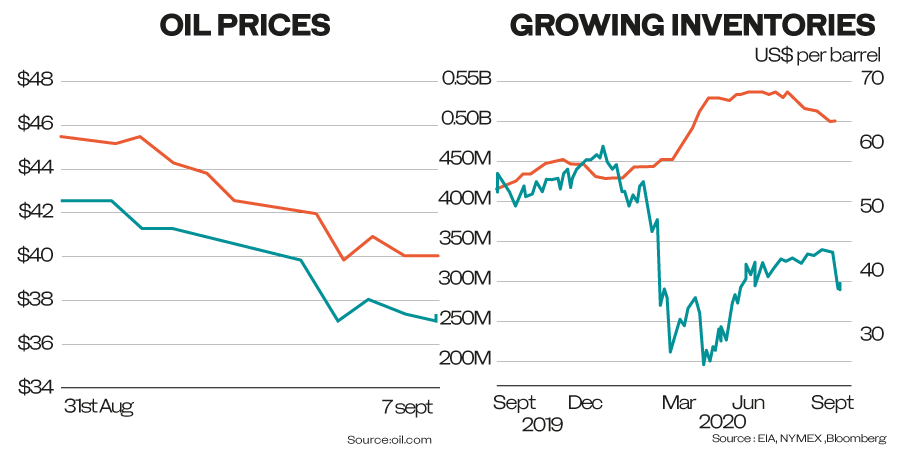

Oil prices are set for their first decline during two consecutive weeks since April. US crude inventories grew for the first time in seven weeks. West Texas Intermediate (WTI) lost between 12 and 13 percent and Brent lost around 12 percent over that time span. This brought the trading ranges down to around $40 for Brent and around $37 for WTI.

The decline was driven by renewed flare-ups of the pandemic around the globe going hand-in-hand with concerns over future demand, particularly for jet fuel.

The refinery maintenance schedules in the US also resulted in lower crude demand from refiners.

On the supply side, OPEC+ put an extra 1.7 million barrels per day (bpd) on the market in August compared to July, according to S&P global.

December futures traded at their biggest discount since May compared to prices a year from now. This widening contango displayed market concerns of an oversupplied market, which will weigh heavily on the considerations for next week’s Joint Ministerial Monitoring Committee overseeing compliance with the production cuts of OPEC+.

In July, OPEC+ adjusted its historic 9.7 million bpd cuts it had adopted in April to 7.7 million bpd according to a pre-agreed downward-sloping scale.

Where we go from here:

ByteDance has asked for an extension to sell its US operations of TikTok to a US company before having them shut down by the US administration. American President Donald Trump’s administration has so far not budged, leading to a potential standoff next week.

Reliance is said to have offered Amazon a 20 percent stake in its retail business, which would give Amazon a substantial footprint in India.

A new US stimulus package is not expected soon while Democrats and Republicans remain far apart, with the former demanding a $2.2 billion package and the latter advocating between $500 billion and $700 billion.

Next week the US Federal Reserve’s Federal Open Market Committee will hold its last meeting before the American presidential elections. Central banks in the UK, Brazil, Russia, and several other countries will also hold their meetings.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources. Twitter: @MeyerResources