Bank lending to the Saudi private sector recorded another solid gain in August, according to a new report.

Jadwa Investment’s chart book for October also says that reserve assets of Saudi Arabian Monetary Agency (SAMA) increased by $4.4 billion in August, their highest monthly gain since March this year.

Economic data for August was strong, according to the Jadwa report.

It says that indicators of consumer spending and PMI picked up with the growth of the former reaching a two-year high. Latest GDP data shows that year-on-year economic growth remained strong in the first half of the year, though nonoil private sector probably grew at its lowest rate since 2011, according to the Jadwa chart book.

The growth of both cash withdrawals from ATMs and point of sale transactions picked up in August. The overall nonoil Markit/ HSBC PMI remained on an upward trend for the third consecutive month in August, registering 60.7, the fastest rate of expansion since March 2012.

Recently released GDP data shows that year-on-year economic growth recorded 4.5 percent in the first half of the year, the highest since the second half of 2012, though nonoil private sector grew at its lowest rate since 2011, the report points out.

Money supply growth touched a 13-month high in August, prompting the monetary authority to step up the issuance of SAMA bills in order to absorb some of the liquidity in the banking sector and reduce the potential impact on inflation.

Year-on-year money supply growth maintained an upward trend in August, reaching 14.5 percent growth year-on-year, added the report. To reduce the inflationary effect of the rise in money supply, the monetary authority stepped up the issuance of SAMA bills which only slightly reduced excess liquidity from banks.

The report added that bank lending to the private sector recorded another solid gain in August. The growth of bank deposits also remained healthy as time and saving deposits continued to benefit from the prospect of higher interest rate while heightened activity in the stock market exerted little impact on demand deposits.

With both demand and time and savings deposits of businesses and individuals going up in August, it

does not yet seem that funds are being drawn down to finance elevated activity in the stock market.

At 80 percent, the loan-to-deposit ratio shows that banks still have plenty of scope to further increase lending.

SAMA reserve assets increased by $4.4 billion in August, their highest monthly gain since March this year. The bulk of the increase in August took the form of investments in foreign securities. The increase probably reflects the transfer of funds that were earned over a longer period of time, since oil revenues in August alone do not justify such increase. The bulk of the increase in August took the form of investments in foreign securities, which rose by $5.3 billion. The distribution between securities and deposits is volatile on a monthly basis.

The accumulation of reserve assets is set to slow over the coming months as oil export revenues fall in line with lower prices and output, according to the report.

It said that year-on-year inflation edged upwards in August for the first time in four months, reversing the flat trend seen since May. The shift was mainly helped by an acceleration of both domestic food price and rental inflation. Other components of the cost of living index recorded sustained levels of relatively higher inflation.

Year-on-year inflation edged upward to 2.8 percent in August, accelerating for the first time in four months.

An acceleration in both food price and rental inflation pushed up the headline figure while other components recorded sustained levels of relatively higher inflation.

According to the chart book, nonoil exports maintained robust year-on-year growth in July, but declined slightly in absolute terms. In contrast, imports continued to fall for the third consecutive month, in both absolute and year-on-year terms. Data on letters of credit issued for imports suggests a reversal in this trend is possible in the months ahead.

The Jadwa report added that nonoil exports maintained robust year-on-year growth in July while imports declined for the third consecutive month in July in both absolute and year-on-year terms (down by $4.8 billion month-on- month and 17 percent, respectively).

New letters of credit opened by the private sector at commercial banks point to a possible reversal in demand for imports over the coming months.

The report also said that ample global supply resulted in Saudi production dropping to 9.6m bpd in August. Iraq, Iran saw oil output remain virtually flat, month-on-month, while Libyan production was down 5.8 percent.

Higher domestic consumption and weaker global demand meant Saudi exports remained at 6.9m bpd, month-on-month in July.

Saudi production dropped to 9.6m bpd, the lowest for the month of August in four years, added the report.

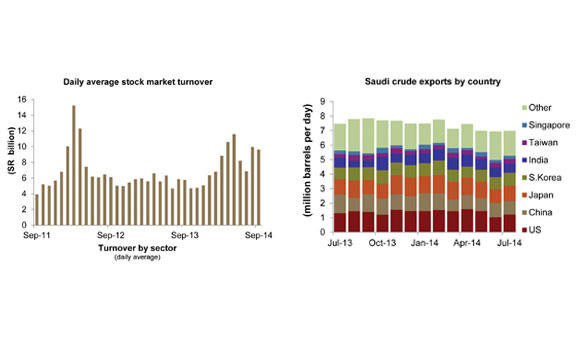

Latest data available shows that Saudi exports remained below 7m bpd for the third month in a row, in July. According to the a chart book, a combination of profit-taking before Eid Al-Adha holidays and investors cutting positions to free up cash before IPO/rights issues, saw the Tadawul All-Share Index (TASI) fall in September for the first time in two months. Furthermore, falling oil prices also negatively affected investor confidence.

The TASI dipped back under 11,000 mark in September, resulting in a 2.3 percent drop in monthly performance, added the report.

The TASI performed less favorably against other global benchmarks in a month characterized by mixed performances by major international indices.

According to the report, the stock market’s average daily turnover fell in September. It dropped in September by 3.2 percent, month-on-month, to SR9.6 billion.

Banks and petchem sectors were prominent again, but the insurance sector, in both daily turnover and as percentage of market capitalization, saw the highest level of traded volumes.

The insurance sector’s daily turnover exceeded both banking and petrochemical sectors resulting in its turnover to market cap being much higher than all other sectors.

In September, the TASI’s price-to-earnings (PE) valuation decreased to 20.68, moving closer toward the two year average of 16.58. PE was higher than comparable indices, except for Dubai. Although dividend yield increased to 2.64, month-on-month, it is still at the lower end when compared to regional and emerging markets.

The risks in over pricing seem to be abating somewhat with the TASI’s PE declining in September but is still quite expensive compared to regional and emerging markets with dividend yield still remaining comparably low.

All but three of the 15 sectors saw negative performances in September as investor selling was felt across most the market. Only the hotel and insurance sectors performed well, whereas even the larger sectors, such as banks and real estate, performed poorly, says the Jadwa report.

Selling of stocks by investors was felt across most sectors, except in the hotel and insurance sector .

The insurance sector was buoyed by strong interim financial results and hotels benefitted from an expected uplift in the forthcoming holiday period. Profit-taking in previously stronger performing sectors resulted in poorer performance in September.

KSA money supply growth touches 13-month high

KSA money supply growth touches 13-month high